SBA 7(a) vs. SBA 504 Loans: Which One Is Better for Buying Commercial Property?

Buying commercial property is a big decision for any business. Among the most popular financing options are the SBA 7(a) and SBA 504 loan programs. Both offer valuable benefits, but they have distinct features that make them better suited for different situations. In this article, we’ll explore the key differences between these two types of loans and help you determine which one is the best fit for purchasing commercial property.

What Is an SBA 7(a) Loan?

The SBA 7(a) loan program is the most common and flexible option offered by the Small Business Administration. These loans can be used for a wide range of purposes, including:

Buying real estate

Purchasing equipment and machinery

Working capital

Refinancing existing debt

2. Benefits of an SBA 7(a) Loan:

Flexibility in Use: Funds can be used for multiple business purposes.

Loan Amount: Up to $5 million.

Long Repayment Terms: Up to 25 years for real estate.

Eligibility Requirements: Less restrictive than other SBA programs.

3. What Is an SBA 504 Loan?

The SBA 504 loan program is designed specifically to support economic development by financing major fixed assets such as commercial real estate and large equipment. SBA 504 loans are structured differently from 7(a) loans and typically involve two separate loans:

Bank Loan: Covers 50% of the total project cost.

CDC Loan (Certified Development Company): Finances 40% of the project cost and is backed by the SBA.

Borrower Contribution: Usually just 10% of the project cost.

4. Benefits of an SBA 504 Loan:

Competitive Interest Rates: Typically lower than 7(a) loans.

Long Repayment Terms: Up to 20–25 years for real estate.

Lower Capital Requirements: Only 10% down from the borrower.

Supports Economic Development: Offers incentives for job creation or community-focused initiatives.

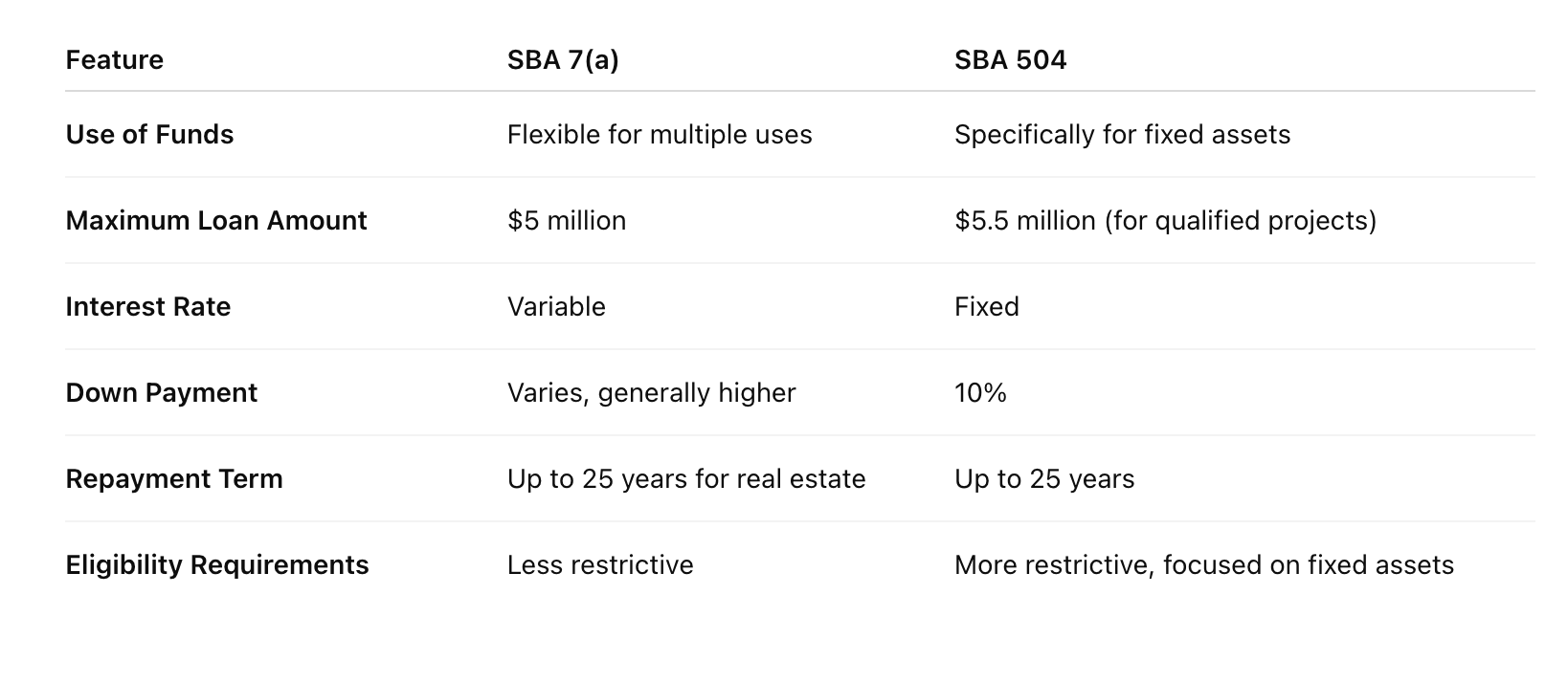

5. Key Comparison: SBA 7(a) vs SBA 504

6. Which Loan Is Better for Buying Commercial Property?

The right choice between an SBA 7(a) and SBA 504 loan depends on several factors:

Purpose of the Purchase:

If you’re financing only the purchase of commercial real estate, the SBA 504 loan may be the better option due to its lower interest rates and smaller down payment requirement.Additional Funding Needs:

If you also need funds for working capital or other business investments, the SBA 7(a) loan provides more flexibility.Interest Rates and Terms:

If you prefer fixed rates and predictable payments, go with the SBA 504. But if a variable rate isn’t a concern and you want more versatility, the SBA 7(a) could be the better fit.

In Conclusion:

Both SBA loan programs offer powerful tools for acquiring commercial property. Choosing between the SBA 7(a) and SBA 504 comes down to your specific business goals, how you intend to use the funds, and your financial situation.

Before deciding, we recommend speaking with a loan specialist or SBA advisor to ensure you’re making the best choice for your business's future.

At Capifinders, we're here to understand your needs and help you navigate the full range of financing options available in the market.